The Proverbial “Needle in the Haystack”…

Back when I lived in Boston, I became acquainted with a leading partner at Bain & Company, one of the world’s top management consulting firms. He was famous for his ability to quickly get to the core insight of seemingly any problem. When asked about this, he responded with something I’ve never forgotten: “Imagine you could get any data in the world to answer the question you’re currently faced with. What would that data look like? Describe it in detail, on paper or in person. And then just go get that data!” At the time I argued that you can’t just go and get any data you want. The world just isn’t that neat and organized.

In the years that have followed, I’ve come to realize that he was right.

This article is more tactical than most we’ve written. It’s going to focus on obtaining “hard to get” data, particularly the rarest (but most valuable) kind of all: direct customer input.

Regularly Interviewing potential and current customers is critical for getting high-caliber feedback on your business. However, it can be surprisingly difficult to find people willing to talk. It’s often like trying to find the proverbial needle in a haystack or the “diamond in the rough”.

Most people try the “easy route” (ex: emailing current customers or posting on social media) and then simply raise their hands and give up when people don’t respond. This is dangerous because you’re then stuck trying to launch/run a business or product without getting crucial feedback. You need to know if you’re truly onto something good or if it’s doomed to fail from the beginning. So today we’re going to provide some tips on how to find people willing to talk to you about your business (even if it means doing some “roll up the sleeves” work).

Scrappy vs. Results

First: All of this advice applies specifically to B2B (business to business) NOT consumer companies. In consumer it’s just very different – you’re not looking for experts, there’s no sales ops, CSMs, etc., no such thing as recorded sales calls, etc. We’ll cover strategies for conducting research in consumer orgs at a later date.

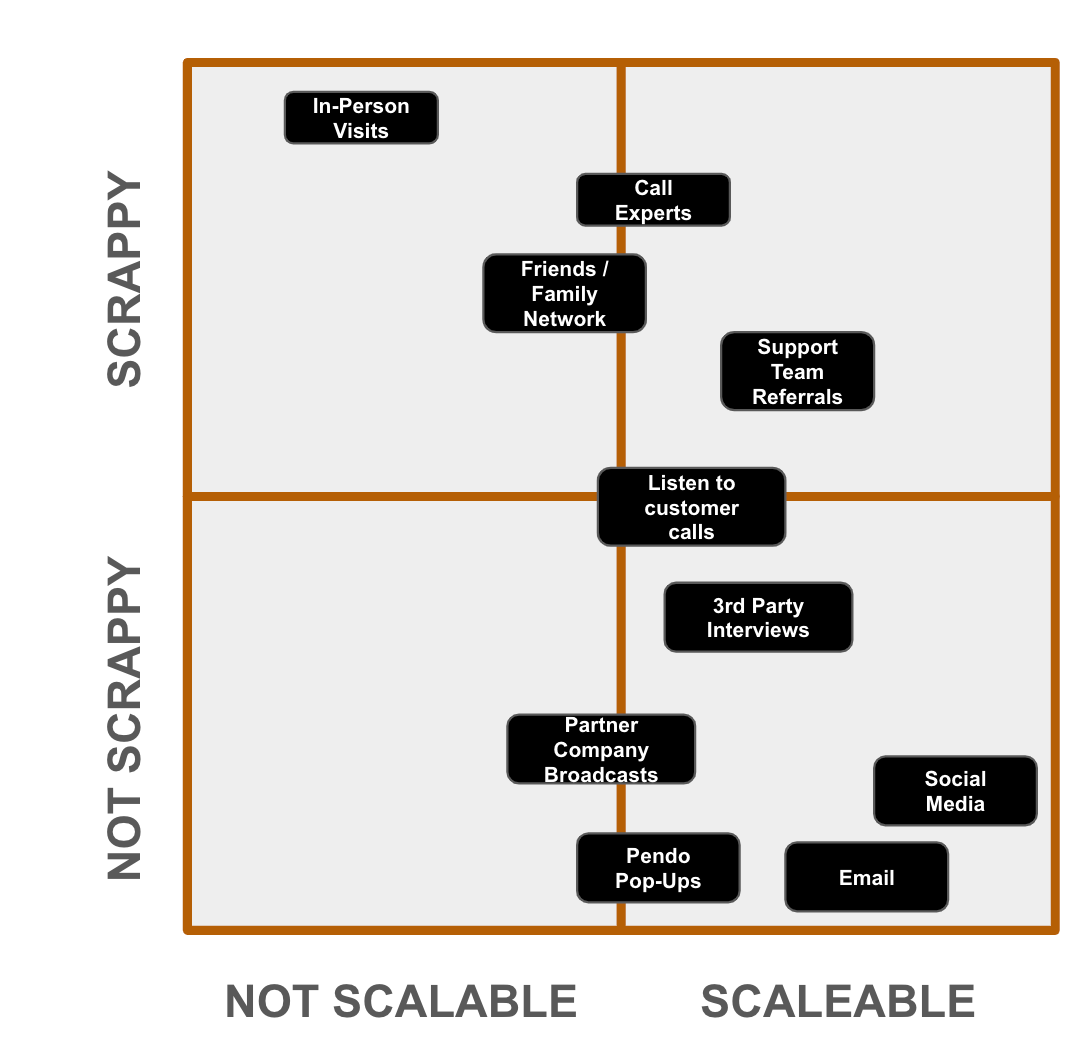

Second: Remember that not all of your efforts to reach customers (or prospective customers) are going to have the same return. It’s a wide spectrum. In our experience, the “scrappier” your effort is, the more valuable the insights. This comes with a tradeoff though. Scrappier tactics are generally not scalable and they require a lot more work, and occasionally a bit of courage too.

You will need to determine how important the quality of feedback is to determining your answer. If you just need a quick gut check on an idea you’re thinking of implementing, perhaps a slightly lower effort (and lower quality) approach will do.

But for major decisions where you simply can’t afford to be wrong, the quality of feedback matters a great deal. This means that you need to be willing to be as scrappy & creative as possible in order to get to the goldmine of answers that you really need.

In short: the degree of the data’s importance should be directly correlated with the amount of effort you’re willing to spend to get it.

So without further ado, let’s dive into some specific strategies for finding “diamond in the rough” customers to talk to.

High Effort (Scrappy) Strategies

A brief foreword: Strategies in this bucket are ones that people don’t typically think of. That is precisely why we’re starting with them. We’ll cover more common/obvious tactics later on.

Tactic #1: Go knock some doors (literally)

Recently, I needed to figure out a tricky problem: Weave (the SaaS company I currently work for) started out by providing dental offices with a combination of software + phones to enable front office staff to communicate effectively with patients. We had expanded our offering to serve other medical specialties (ex: Optometrists, Physical Therapists, etc.), but one group in particular, Veterinarians, was proving extremely difficult to sell to. We needed to figure out why Weave wasn’t working for them so we could make the necessary adjustments to really start capturing market share.

Many people at the company suggested sending out surveys, doing research online, or even calling a few customers. All of these were fine ideas, but my team decided to try something different. We would simply call up a few local vet clinics and ask if we could swing by in person to ask them about how Weave could serve them better.

We did about5 of these in-person interviews, and the results were eye-opening and answered questions that weeks of secondary (internet-based) research had failed to address fully.

There is something powerful about just showing up at a customer’s door with a $50 gift card in hand and asking if you can do an interview immediately or get them on the calendar (making it clear that you’re not selling anything). This is the definition of something scrappy that doesn’t scale, but it can be extremely effective (it’s certainly a lot more effective than contacting the customer via phone or email).

Tactic #2: Call up the experts

Cue the Ghostbusters theme. When you really need answers sometimes the best thing you can do is find people who eat/sleep/breathe these kinds of problems 24/7. In other words, experts. A phone call (or live interview) with one of these is often worth hundreds of hours spent doing anything else. The more specific the area of expertise, the better.

A few years ago I was trying to figure out the exact number of dental offices in the USA as part of our effort at Weave to understand how large our market opportunity was. This sounds like a simple question to answer, but we discovered pretty quickly that while there was a lot of data on the number of dentists in the U.S., data on the number of dental offices (physical locations) was much much harder to come by.

One afternoon I found myself on Google Scholar looking for any academic papers that happened to cite research on dental market sizing. That’s when I came across an obscure paper (produced by a professor at the University of Ohio-Miami) that cited a specific number. I quickly sent an email to the professor (and his paper’s co-authors) saying that I had read their paper, loved the research, and was curious about the methodology + data sources they had used to calculate the size of the United States Dental industry. Within 4 hours I had gotten a reply from 2 of them, both offering to chat with me on the phone. One of these academics was now serving as the Chief Economist of the American Dental Association (ADA). We spent over 4 hours discussing the market size and I came away with the exact number I was looking for. Can you imagine a better source for Dental Data?!

What I learned from this: You can find experts on almost anything if you’re willing to look for them.

Academics are often a great starting point when looking for experts in a given area. Professors LOVE to talk about their research (particularly if it’s in a field that doesn’t generally receive a lot of attention or publicity). People like talking about their work and enjoy the attention.

Be sure to use the “network effect” to find others to talk with. Always end a conversation with “Do you know any other experts in [XYZ Field] that I should connect with?”. Folks will often go out of their way to connect you to additional people in their network (other academics, economists, consultants, business leaders, etc.) if they sense you are genuinely interested and appreciative of the time. You want to get referred to (ideally via warm introduction) more and more people to talk to in your quest for the right answer.

Some breeds of experts (ex: consultants), will often be willing to put you in touch with their clients for a small degree of compensation as they are typically looking to expand the value they are offering in their field. You simply have to ask.

Tactic #3: Ask your company’s customer support team for customers to talk to!

If you work in a company with a Customer Service Team, they are wonderful at identifying customers who would be great interviews. Ask for customers who are really happy or really dissatisfied. For starters, you want people who truly love or truly hate your product, because they’re the most likely to give you candid feedback.

Ask your Customer Service teams for a list of customers who have very high NPS (Net Promoter Score) or CSAT (Customer Satisfaction Scores). Some CSMs also have direct relationships with these customers (as they are part of the CSM’s “book of business”) and can make a warm introduction for you.

Be sure to review all notes / support tickets on a given customer before chatting with them so you’re walking into the interview prepared with their history. You don’t want to make the mistake of assuming a customer is a happy customer when if you had simply read their log you would have known that this is someone who is extremely frustrated with the company.

Tactic #4: Work the “Friends and Family Network” (and ask your team to do the same)

Ask your friends and family for introductions to people they know who you think would be ideal interviews for whatever question you’re trying to answer.

There are a ton of people you know well who have additional relatives, friends, and acquaintances who work in the XYZ industry and would be willing to chat with you (as a favor to them).

For example: I recently asked my relatives (and friends) if they knew anyone who worked in a very specific field: Medical Electronic Health Records (EHRs). I needed to chat with a Medical EHR expert to determine if my company could successfully integrate with the key systems of record (large databases of patient data) in the local healthcare space. Fortunately, I had two family members who knew friends + co-workers who did this exact job. This led to 2 incredibly insightful interviews!

Pro Tip: Ask your team to work their family + friends network as well. The principle here is to get as many possible “warm referrals” as possible.

Low Effort (Scaleable) Strategies

Another brief foreword: The title of this group of tactics is a little misleading. Any good consultant or product manager will tell you that it actually takes quite a bit of work to develop a good survey or email campaign. There is some truth to that. But this group of strategies generally requires less work up front, and almost always is easiest to scale. That is precisely why they’re such favored and common tactics.

The downside is that they also tend to engender a bit of laziness among those who employ them. Be wary of falling into the trap of thinking that you’ve exhausted all options simply because you didn’t get results from any of these tactics. Often, that is simply a cover for doing something that makes us a little uncomfortable (like actually talking to a customer face to face when we’d much rather just “learn from a distance”).

Tactic #5: Bulk Outreach (Email, Pendo PopUps, Social Media)

Email: Go talk to your company’s revenue operations or support team and get a list of existing customers (or sales leads) and then simply schedule a mass email campaign asking if customers will either (A) be willing to chat with you directly, or (B) take a few minutes to answer questions in a survey you’ve attached.

If you want to get more advanced, you can develop a “drip campaign” (a series of emails that go to customers/prospects on a predetermined schedule). If you’re unsure of how to set this up, just talk to your marketing department and they can help you out.

Social Media: Another option in this vein is to post in social media forums where customers/prospects tend to hang out (ex: Facebook Groups, LinkedIn, Instagram, etc…). X (formerly Twitter) is surprisingly effective for connecting with individuals as well. I’ve found that this approach is generally best accompanied by an offer of some kind, for example: A $50 Amazon or Target gift card in exchange for a 20-30 minute interview. Again, make it clear that no sales pitch will be made.

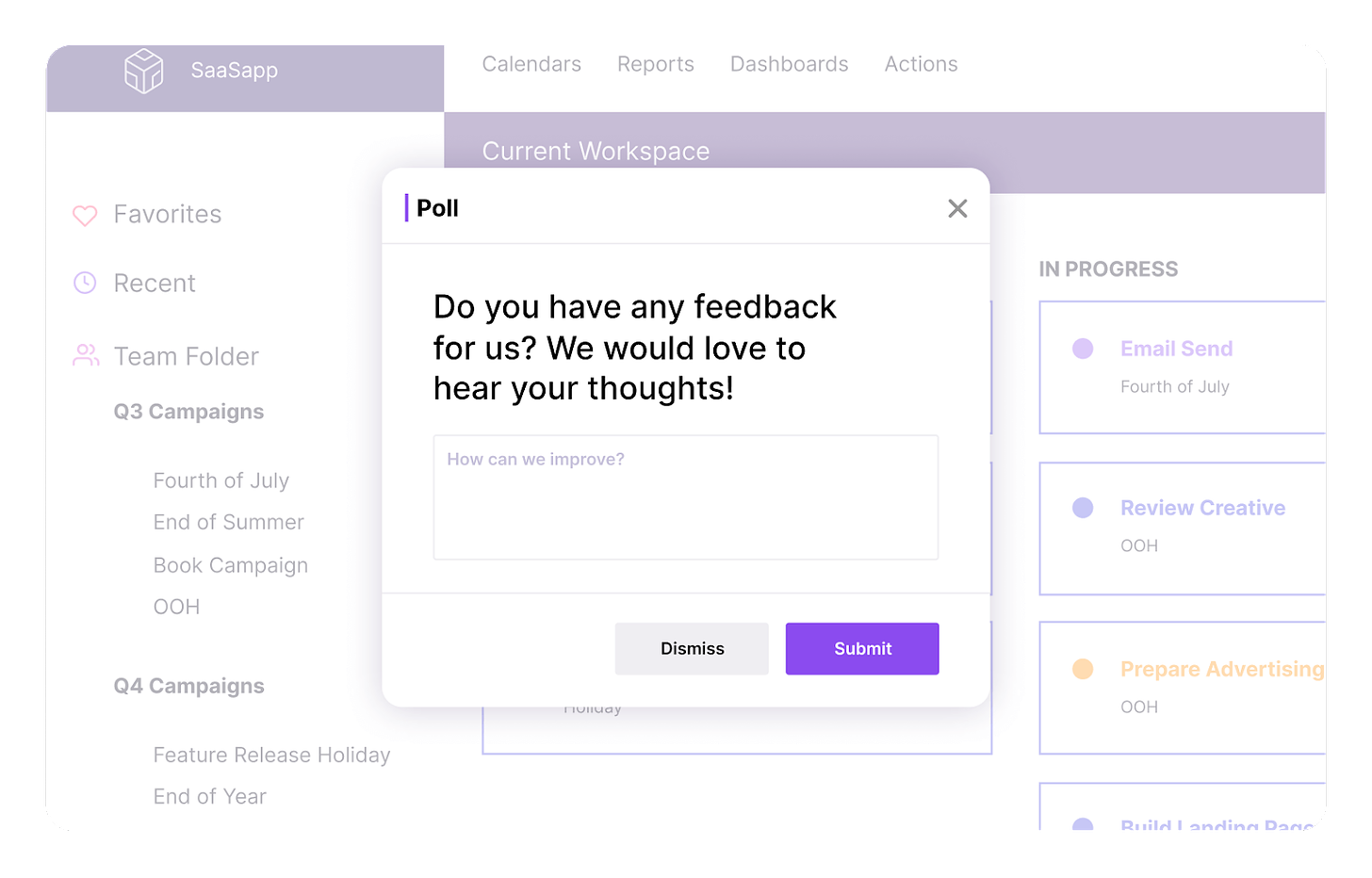

Pendo Pop-Ups (the little windows that pop up in your software) can also be effective mediums. You can usually work with your product team to have a few Pendo messages scheduled with brief survey questions (I highly suggest you think hard about which segment of your customers you want to receive these)

Tactic #6: Use Partner companies to help broadcast your ask

This is a spin on the take above, but using a partner company to help source leads/customers. If your company has a partnership with another business, ask if that company would be willing to distribute your interview request / survey to their customer base. This is a great way to “broaden your reach”.

Tactic #7: Listen to existing sales/support calls

Almost every customer/prospect call these days is recorded (ex: many companies use software like Gong or Zoom to handle these calls; both these platforms will have recording features). Simply go and dig up samples of the kind of calls you want to listen to for the insights you’re looking for.

It can be eye-opening to listen to customers calling in “in the wild” (since people act very differently when they’re being interviewed). Listen to a variety of call types, as each will offer a unique set of insights. Some common ones I suggest are:

- “Closed Won” Sales Calls (where the customer buys the product or service)

- “Closed Lost” Sales Calls (where the customer doesn’t buy the product or service)

- Support Calls (for all types of issues)

- SWAT Calls (when a customer calls in to cancel their service / demand a refund)

When listening to these calls, we find it helpful to ‘score’ the interview. This entails tallying up common themes you hear. This not only gives you something productive to do during the call but helps you spot trends sooner.

The downside of the “call listening” tactic is that you can’t ask questions since it’s just a recording. But this is easily the easiest batch of customer insights to get since the data is literally at your fingertips.

Tactic #8: Get a 3rd Party to quickly find interviews

A final option is to get a 3rd party company to go and source interviews for you. Some of these companies will even conduct the interview or survey on your behalf and then return the analysis (and raw data) to you.

This can be expensive, but also can yield some incredible interviews.

Some of the best 3rd party firms that specialize in customer research like this are:

- Guidepoint

- Third Bridge

- Alpha Sights

- GLG

- There are dozens of others… (see picture below)

When I worked in consulting, we would often rely on specialist groups like this to quickly source expert interviews for time-sensitive questions our client was asking.

These groups also cover an incredibly wide variety of industries. I literally had someone from Guidepoint reach out to me (without prompting) yesterday offering to source Veterinary customer interviews for my company. It was a little more expensive than I was willing to spend at the time, but the option was there!

A few general tips once you’ve found someone to talk to:

- You’ll be amazed at what a $50 Amazon Gift card can do

- Always ask for referrals (many prospects will forward you to others to talk to!)

- Don’t come in with a sales pitch (if you’re doing research). Make that super clear upfront. People are happy to be viewed as “experts”. They hate being “sold” anything. You’ll get a totally different experience based on how you approach this

- Send a thank you note afterward

- Come prepped! Don’t just show up and ask a random bunch of questions. Take time to think about the top ~3 things you want to learn. Have a prepared interview questionnaire, and even share that with them 1-2 days in advance so they can start thinking about their answers.

- Shut up and listen. Remember that you are here to learn, not to defend or sell your business/product (I’ve seen too many product managers or marketers defensively start taking over the interview explaining why their product is so great once a customer starts to criticize it rather than just listening about why someone genuinely doesn’t like what they’ve built)

A Final Warning: Remember the Honestly Curve

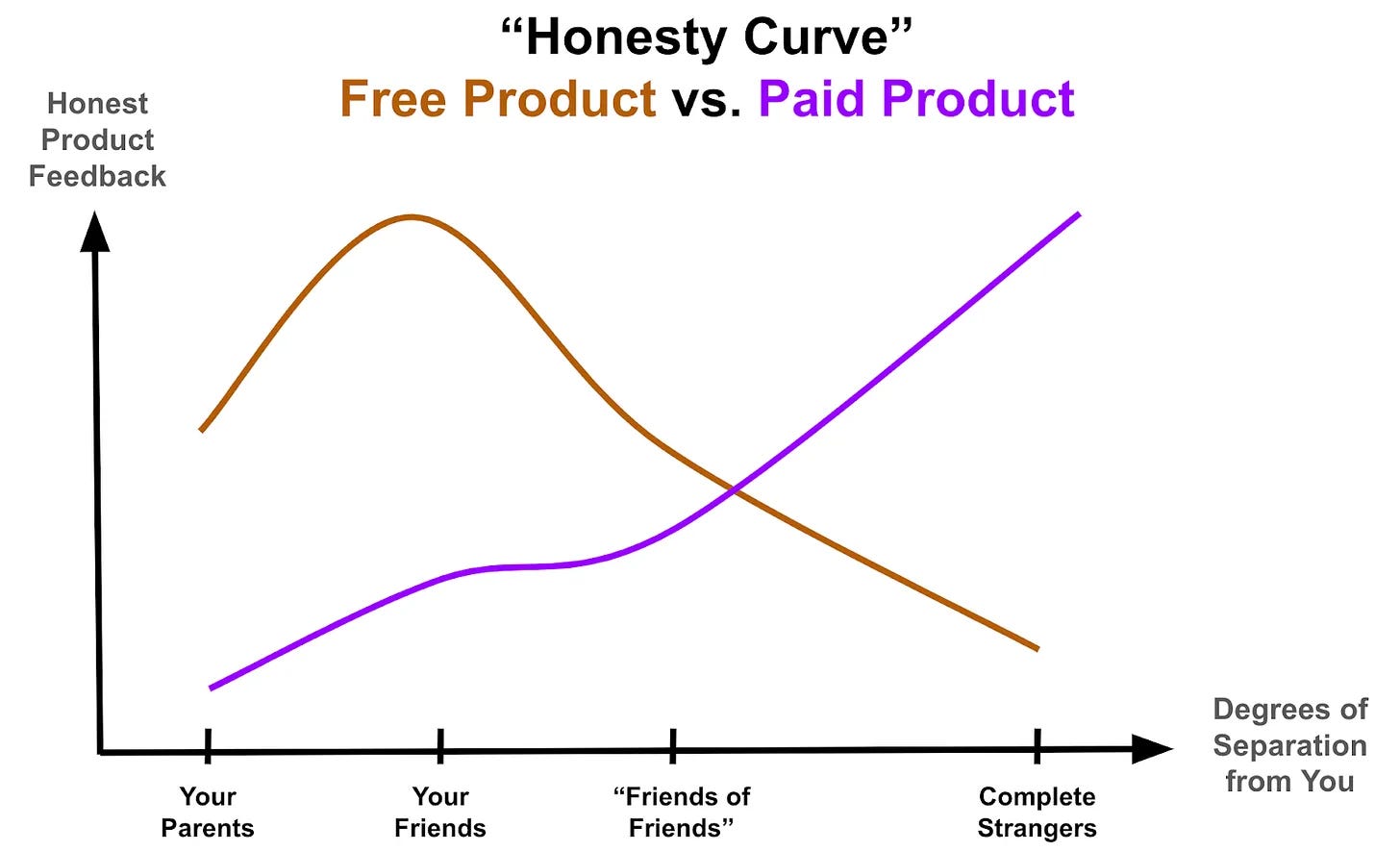

As a last word of advice, be sure to remember the “Honest Curve”. This is a topic we’ve written on previously, but it bears repeating.

The main takeaway is this: don’t treat all customer feedback the same. Who you decide to trust will depend greatly on whether or not you’re offering a free vs. paid product. It turns out that not all customers should be listened to equally…

Conclusion

If you’re interested in other resources/ideas for sourcing customer interviews you’ll be amazed at what you can find online. Here is just one example of a Video from Y-Combinator on “How to Talk to Users’ ‘. There are dozens more like this if you’re willing to spend some time on YouTube, Reddit, or even ChatGPT.

There is no “perfect” way to find the data you want. Customer insights are hard. It’s why so many companies struggle to find product market fit or the next wave of growth. But it is possible.

Just remember: “You can get almost any data in the world if you’re willing to be creative and scrappy. Almost anything can be found if you’re willing to look outside the easy/obvious solutions”

Best of luck to all insight hunters.