“The valuation is too rich.”

“What’s their gross margin profile?”

“What’s their headcount breakdown?”

These sentences would have made no sense to me 10 years ago, and just today I said all three (knowing what they meant, too 😉).

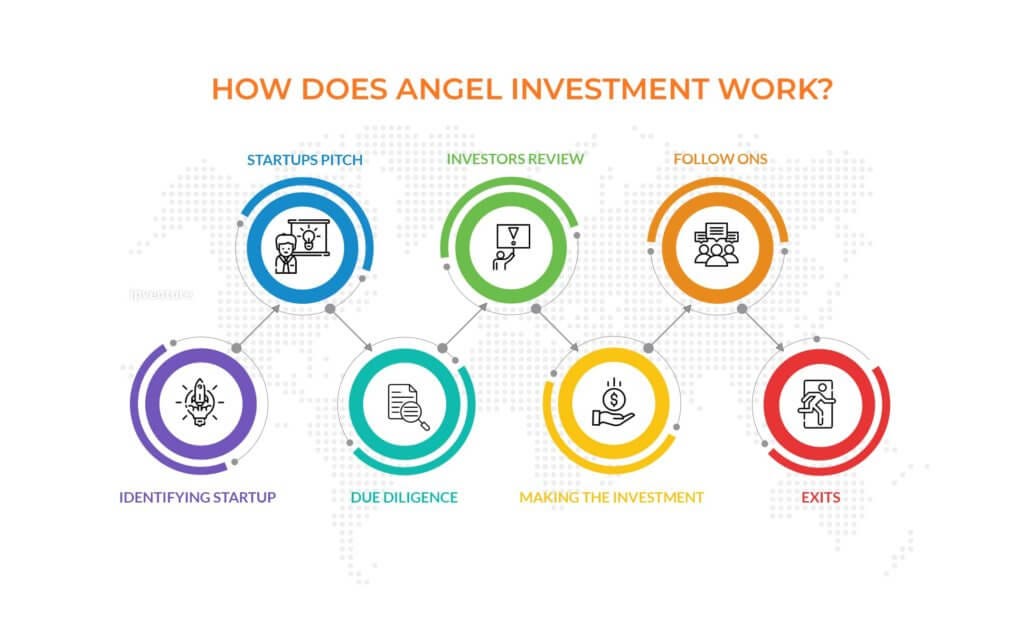

Welcome to angel investing, where you invest money in companies that are just starting, in the hopes that one of them will pay off big.

Here’s what I’ve learned so far.

What is Angel Investing and Initial Surprises

Simply put, angel investing is giving a company that just started money in the potential chance for a huge return on that investment. As they grow, your investment becomes more valuable.

There are multiple ways to invest in companies, both as part of a group or as an individual.

When I invest in a company through an angel group, I have already paid money into a fund and a portion of that money is given to that company. These angel groups typically source deals and let the investors choose. I’m part of one such group and love the deal selection process. If you’re ever looking to start your own company and raise money, this would give you a unique view into this world as you sit on the end of the desk that selects deals. Probably most importantly it shows what types of companies don’t get funded.

When I invest personally it’s usually through someone I distantly know or was introduced to. These deals are often very simple – you write a check and get a portion of the company. Some cashflow positive companies will pay dividends, but most do not.

In both scenarios it is expected to get regular updates on the companies – their sales numbers, profitability, key hires, etc. However, it was surprising to me how little power I have as an investor. I had imagined being brought in for big decisions, asked for help, etc. but the truth is these companies are just grinding, so unless I have a key contact or referral I’m more like the bank. I remember talking with a friend of mine at a venture capital firm and she shared the same sentiment – the companies are very responsive during financial transactions, but otherwise are pretty quiet.

You get paid a big return when there is an “exit event.” This usually involves the company going public, having a new major investor that buys up shares, or the company themselves buying the shares.

For simple math, it I put $1,000 into a company at a $100,000 valuation and had 1% share, when that company has an “exit event” that values the company at $100M and offers to buy my shares, those would be worth $1M (1% of the valuation).

Considering most companies that go public are worth closer to $1B, you can see how an investment early on could be meaningful. This is sometimes called the power law, as your initial investment can be worth such high multiples later.

Note all of this is overly simplified, as there’s lots of different structures, shares can be diluted, etc. but this is directional.

Questions Asked, Lessons Learned

Here’s some general questions you want to understand when investing in a business:

- Founders: Who are they? What makes them uniquely positioned to start this company? Could anyone else start this?

- Opportunity: How big is this opportunity? If they only got 1% of the market would that be meaningful?

- Product: Is their product uniquely positioned? Do customers actually use and like it?

- Why: Why do they need investment? Why now?

- Valuation: How much are they asking for relative to their revenue, profit, or other relevant numbers?

- Big: What is one thing that would need to be true to make this big?

I have learned it’s extremely easy to pick apart a business, but in angel investing these companies are just starting (many are less than a year old), so you need to shift your mindset towards pessimistic optimism.

Now have I made any money from my investments? Not yet! Do I expect to? Hopefully one day, but I’m not expecting it. Today I’m invested in all types of companies – an AI company, a fuel delivery company, an HR software company, and many more. They are all very different.

With angel investing, even if I choose really well, it’s likely that only 1 in 10 of my investments will pay back at all. What you really hope for is that one company that really makes it.

I have worked for two companies that have gone public and paid out 100x+ what those early investors put in. So it’s possible!

Conclusion

I have thoroughly enjoyed my investing experience. It has given me exposure to a myriad of different companies, a unique perspective as an investor, helped me make great connections (both with the companies and fellow investors), and hopefully one day some amount of financial return.