A walk through the massive workload, loneliness, and triumph of taking a company public

I had always wanted to take a company public. I imagined the glory of ringing the bell, being surrounded by my battle born coworkers, and becoming rich. The reality is those are things that happen, but the path there is long.

This article is about that path.

Intro: What’s Traeger?

Traeger, which makes wood pellet grills, had been growing ~30% each year for about 6 years. Covid had accelerated our growth since many people took up cooking during the pandemic. It was over $500M in net revenue, and is a perfect business in many ways because it:

- Sells a high end product (grills up to $4,000)

- Sells consumables that provide recurring revenue (pellets are required to cook on the grills)

- Has a technology component (an app that connects to the grill)

- Has a wonderful community (people get Traeger tattoos, name their babies Traeger, etc.)

We were a few months into 2021 and wanted to go public that summer, and there was a lot of work to do. But first, why did Traeger want to go public?

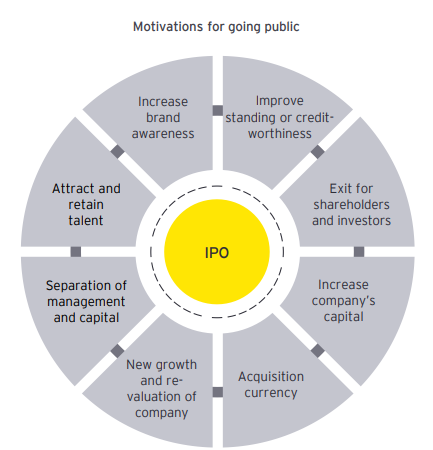

Why Companies Go Public

One of the first things I learned when taking Traeger public was that we were big enough to go public. I had thought you had to be a huge company, but there’s companies that go public who “only” have $100M in annual revenue and others who have $10B.

The trigger is usually one of the following:

- Exit for Shareholders/Investors. People who have invested money/time in the company want a return, and by going public they can cash that in.

- More Money. Going public (even though it costs millions of dollars) is a great way to raise money for your company.

- Forced IPO. Your company has given out shares and is approaching 500 shareholders; any more than 500 you need to be publicly traded.

There’s plenty of other reasons too, and in Traeger’s case it was a nice exit opportunity for shareholders and infused the company with money to pay off debt. There’s also some nice ancillary benefits that Traeger gained, such as higher brand awareness (e.g., people who might not know much about grilling now see news updates) and to attract talent.

What I Did to Take Traeger Public

My role at Traeger was the Director of Consumer Insights & Strategy. My team and I oversaw the market data, consumer trends, and strategic planning in the company. In my role I oversaw many of the company’s large projects, and this IPO was going to be one of them.

There’s two major parts of going public, which I’m going to simplify here:

- Brand/Strategy – explaining your company, selling it to investors

- Financial/Legal – clearly showing your financials, includes audits

In my role I led out on the brand/strategy side. I contracted with a major consulting firm to do a study of the grill market we could cite, as well as pull together information across the company to tell the brand/strategy story. This was intense! We did a massive survey and interviewed experts around the world in just a few short weeks. Any company data I had to triple verify, and I had this massive spreadsheet with all these stats, the sources, and links to the data. It felt like a bibliography from hell. All the time our lawyers would review, probe, and ask for more.

These were some of the longest days I have worked in my career. I remember getting on calls on Saturdays with lawyers/bankers to review my work. I’ll also add these were some of the most lonely. I couldn’t tell people what I was working on, both within work and outside of work. If I did it could compromise us going public.

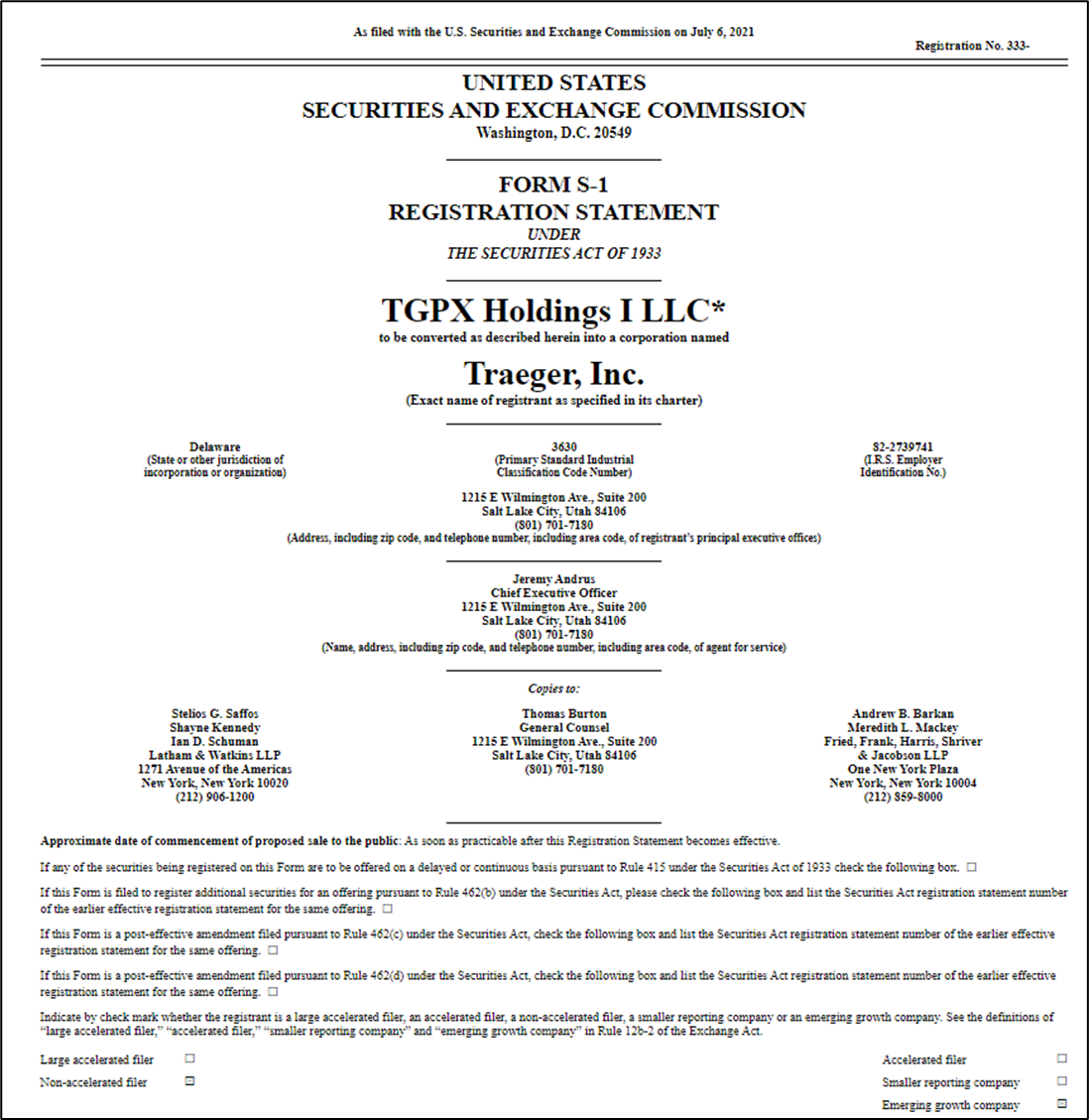

This all culminated in Traeger’s S-1 document, which is what’s filed with the government and that every person can read to learn about the company.

S-1 documents are fascinating. I read them all the time (and read dozens while prepping Traeger’s). They tell amazing brand stories, all sorts of financial information, and you can even see how much the top executives are paid. Yes that’s right, it shows their salary, bonuses, and everything else!

Traeger’s S-1 document

After getting your S-1 document done there’s a number of meetings you have with investors and banks. We prepared for an Analyst Day, where we essentially presented about Traeger a couple of weeks before going public and the investors can ask questions. We did this via Zoom with the most beautiful and robust Powerpoint presentation I had ever worked on. For context, I have built hundreds of Powerpoints in my career, and none have been or will ever be like this. Every page was jam-packed with information, each graphic carefully scrutinized, and we rehearsed so many times we easily had our parts memorized.

Since I built a lot of it along with our investment bankers from Morgan Stanley, I actually ran the presentation from my computer when the big day came. I remember in one of the rehearsals my internet at home crashed and it was not going smoothly, so I just grabbed my laptop, hopped in my car, and sped into the office to have more reliable internet. It was a good lesson to be in a stable spot for a presentation that literally led to hundreds of millions of dollars being transacted.

Going to New York for the Big Day

We had decided to list on the New York Stock Exchange (ticker is COOK). The leadership team all flew out to New York and our big day was July 29, 2021. I didn’t sleep great the night before since I was so nervous. We knew our stock price would be between $16-18 but didn’t know where in the range it would fall. I remember trying to probe any information out of our CEO that night but he wouldn’t budge.

Approaching the New York Stock Exchange we had hung a huge banner (see below).

The president of the NYSE spoke to us, we had a light breakfast, and then we went onto the historic trading floor to ring the bell. That part was fun – we were all laughing and cheering.

Afterwards it was so neat to see yourself on the news, see the stock trading up, and I must have gotten a hundred texts from friends/family congratulating me. In my mind this was a culmination of the years of work it had taken to get to that point.

At the New York Stock Exchange the day Traeger went public

After leaving the NYSE we wandered back to our hotel and just sat talking and celebrating. I remember checking the stock price about every 10 minutes that day since I had shares and since I wanted to see how it was trading.

Hanging out at our hotel after going public

Conclusion

Helping take Traeger public was one of the largest, hardest, and fulfilling projects I have ever worked on. I feel tired just thinking about it. There were so many others who helped too. Ultimately I’m so grateful I had the opportunity to have a front row seat to the experience, and would do it again in a heartbeat.