One of my neighbors worked his whole life and dreamed of retiring and finally buying a boat. He retired, bought his dream boat, and then was suddenly diagnosed with cancer. He unfortunately fell into poor health and died a couple of years later, never able to take out his prized boat. It sat unused in his driveway.

While extreme, I hope this isn’t me. Or you.

So here’s a provocative thought: You should die with a lifetime of experiences, relationships, and giving, with zero dollars in your bank account.

- Wait, isn’t the whole point of working to save enough to retire on? Nope, we’ll cover that.

- Hold up, what about leaving money for my kids? We’ll discuss that.

- What do you mean by experiences? We will cover that in depth.

While most of our articles focus on unwritten business advice, this article is focused on unwritten life advice (which is supported by your career decisions)

What Is “Die with Zero”?

The idea to die with zero has been around for centuries, but has been popularized recently in the book Die with Zero: Getting All You Can from Your Money and Your Lifeby Bill Perkins.

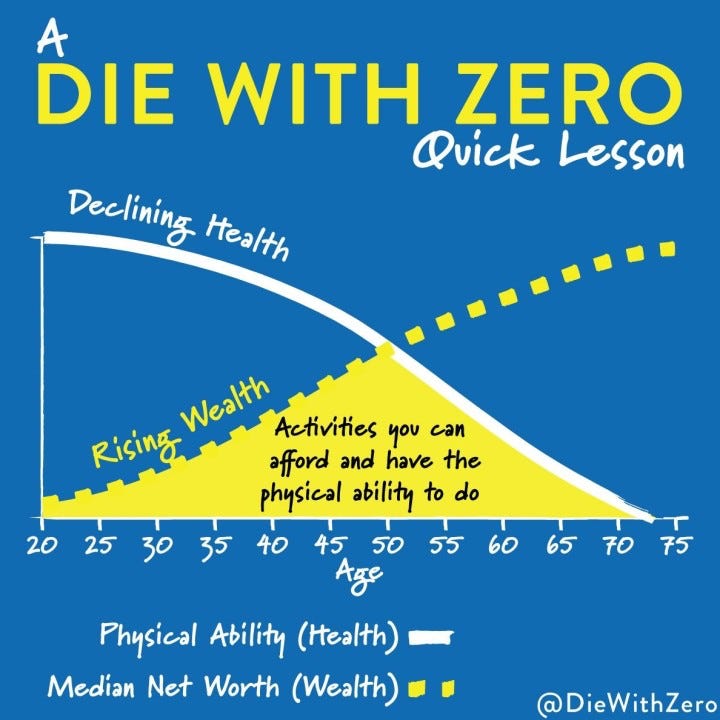

It is simple: You should maximize your life experiences, relationships, and giving at the time you can best have them, and stop worrying so much about saving for retirement.

As taught by Bill Perkins (and will be the only quote in this article):

“Life is NOT a game of Space Invaders – you don’t get points for all of the money you rack up in the game but many people treat it as though it were. They just keep earning and earning, trying to maximize their wealth without giving nearly as much thought to maximizing what they get out of that wealth – including what they can give to their children, their friends, and society now, INSTEAD of waiting until they die.”

Retirement: How Much Is Needed?

Most Americans don’t know how much they need to save for retirement. I certainly didn’t. I was told to save 20% of my income, maximize my 401k, and to not go into debt.

On any normal income (even with a college degree) this is incredibly difficult to do. Like most people, I have found it difficult and perplexing to try to weigh tough decisions like whether I should take a trip with my family or save up for a down payment on a home. I always wished I had more money, and it felt like company bonuses were often the only savings I had. Now that I’m further into my career this is less of an issue, but it still feels like a nebulous cloud.

It’s actually fairly easy to estimate how much money you will need when you retire. There are two steps:

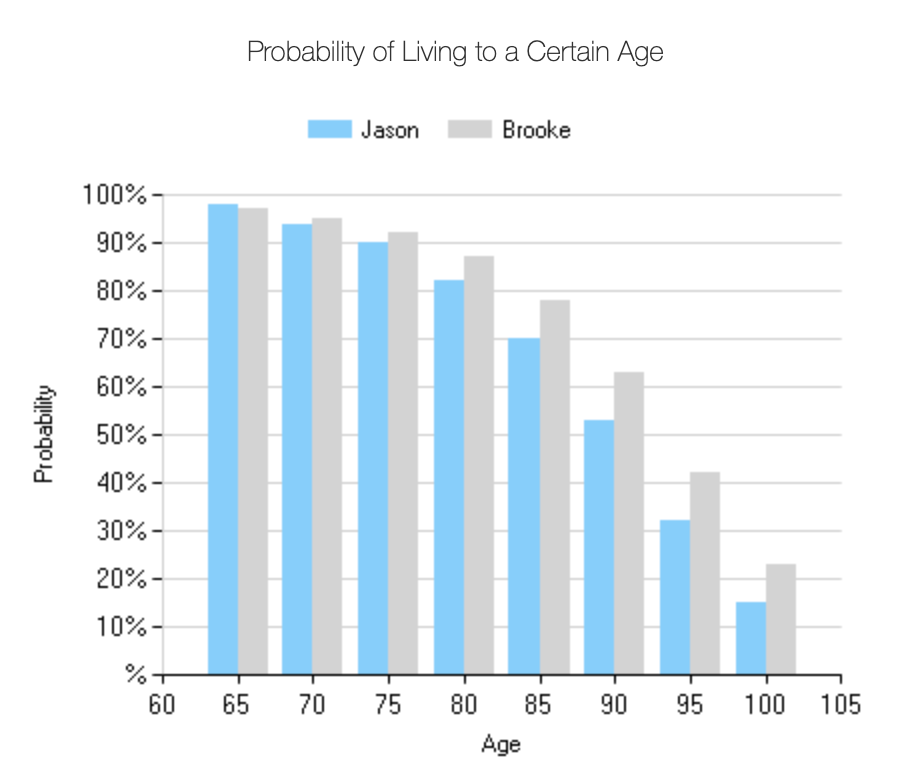

- Determine your life expectancy. This sounds fairly morbid, but until this year I had never calculated how long I was predicted to live. While there’s many life expectancy calculators out there, the most credible one is likely this one that is governed by actuaries (link here), whose job it is to estimate life expectancy. In the US, the CDC estimates the average person male will live to be 75 years old and females to be 80 years old. I hope to beat the average, so in any calculation I add a few years.

- Determine your future monthly expenses. Do you plan on owning your home when you retire? Traveling? You just need to determine approximately what you’ll need. For example, I plan on owning my home and traveling at least monthly. I’ll also need some money for medical expenses, although the truth is that Medicare will likely cover any major expenses.

You can use a simple calculator like this one to estimate what you’ll need to have when you retire. For me it was shockingly low. One consideration when you look into it is that your investments will be making money, and you can live off of those residuals for quite some time before dipping into your honey bucket.

For most Americans, while you can start collecting social security at age 62, the majority wait until they are 67 to begin withdrawing to have a higher monthly payout. The downside here is those are five of your golden years and likely the last time you can have certain experiences. In all likelihood if you used a calculator you would find you could comfortably retire at age 62 or before.

What About Leaving Money for My Kids?

A few years ago I was talking with my friend Scott about updating my will. He shared that he recently updated his too, and that he and his wife had decided to give their kids their inheritance when they turned 35 years old instead of when he and his wife died.

I was puzzled. “Why 35?”

He answered: “We just thought about it. Any earlier and it’d probably ruin the kid. But by the time you’re 35 years old, you’re usually working in a career, have a home, and that money could be life changing. They could start a business, invest in their children’s college funds, or use it however they like. If they only get it when they’re 65 they won’t even need the money!”

My wife and I talked about it and updated our will to be the same.

We ultimately decided we would rather have more experiences now with our children, and then give them their inheritance at a younger age when they could in turn have more experiences.

What’s an “Experience”?

Most of us default to experiences equaling traveling. For you that may be the case, but here’s some other things it could be:

Eating: Some of my fondest memories are restaurants and cooking. For example, eating at a Michelin-star restaurant or cooking a tomahawk steak. Those were worth every penny.

Events: There are so many events, both in your backyard and when you travel. I love running and have been blown away at how many races are within an hour of my house, as well as what the driving distance is for a weekend trip.

Donations: While donating money when you die is wonderful, wouldn’t you rather see in your life what is done with it? Our family has decided to support Utah Refugees, which has created focus in our donations and wonderful volunteer experiences for our family.

Stays: We love camping and booking nearby cabins, often with friends and family. These memories are priceless to us.

It’s often easy to justify buying a new car, a boat, etc. but before buying you should consider what experiences it will give. I would far prefer to drive an older vehicle, not remodeling my kitchen, and having fewer clothes in lieu of creating lasting memories with my loved ones.

Conclusion

Much like having an intentional career, you should be intentional with how you save for the future. And unlike you were likely taught to save for retirement, you should save enough for retirement while having experiences today.

Our best advice is work hard today, balance it with experiences, and don’t wait too late to retire. Die with zero.